Image source: https://www.theguardian.com/media-network/media-network-blog/2013/dec/12/first-ever-banner-ad-advertising

From 44 Percent to Background Noise

On 27 October 1994, AT&T spent US $30,000 to place that 468 × 60 banner above at the top of HotWired. About forty‑four percent of visitors clicked—the ad was such a novelty that readers emailed friends to share the screenshot. Fast‑forward to today and the average banner on Google’s Display Network musters just 0.46 percent click‑through, which means one person in every 217 even notices. The gulf is not about creative talent; it is about economics. The supply of ad impressions ballooned with every new website, social feed, and mobile app, but the supply of human attention stayed fixed at twenty‑four hours. The result is classic deflation: each individual impression is worth a fraction of its 1990s value.

1 | Search: intent still pays but the toll keeps rising

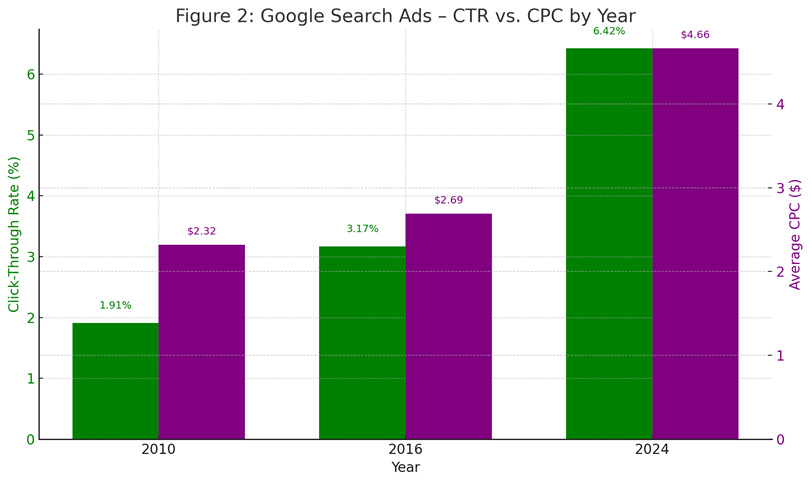

When banners became wallpaper, Google re‑framed advertising as an answer to a question. By pairing text ads with explicit queries, AdWords (now Google Ads) let brands buy real consumer intent instead of vague demographic guesses. Early adopters paid pennies per click while competitors were still renting home‑page takeovers. That honeymoon ended long ago. In 2014 the average cost‑per‑click across all Google Search campaigns sat near $2.32. By 2024 the figure had risen to $4.66 while click‑through moved from roughly two percent to more than six percent. Automation, larger ad inventory above the fold, and a decade of machine‑learning bid strategies squeezed nearly every ounce of waste from the auction. The irony is that these efficiencies push prices higher: the more accurate the targeting, the more advertisers are willing to bid for each incremental click. Microsoft Advertising provides a useful foil. Bing queries represent only a tenth of Google’s global volume, but its auction is less crowded, so the average cost per click hovers around $1.50 while click‑through sits just under three percent. Marketers who optimize for return on ad spend often blend the two engines, letting Bing deliver cheaper conversions while Google soaks up volume.

Google Search Ads – CTR (%)

· 2010 CTR = 1.91%

Source: WordStream, "Average Click-Through Rate in AdWords by Industry" (2010)

https://www.wordstream.com/blog/ws/2016/02/29/google-adwords-industry-benchmarks

· 2016 CTR = 3.17%

Source: WordStream, same link as above (updated with 2016 industry data)

https://www.wordstream.com/blog/ws/2016/02/29/google-adwords-industry-benchmarks

· 2024 CTR = 6.42%

Source: First Page Sage, “Google Ads Benchmarks: CTR & Conversion Rate by Industry” (2024)

https://firstpagesage.com/seo-blog/google-ads-benchmarks/

Google Search Ads – CPC ($)

· 2014 CPC = $2.32

Source: HubSpot / Search Engine Watch via WordStream historical benchmarks

https://www.wordstream.com/blog/ws/2016/02/29/google-adwords-industry-benchmarks

· 2016 CPC = $2.69

Source: WordStream, same link above (based on their 2016 dataset)

· 2024 CPC = $4.66

Source: First Page Sage, “Google Ads Benchmarks: CTR & Conversion Rate by Industry” (2024)

https://firstpagesage.com/seo-blog/google-ads-benchmarks/

2 | Retail Media: Checkout Is the New Search

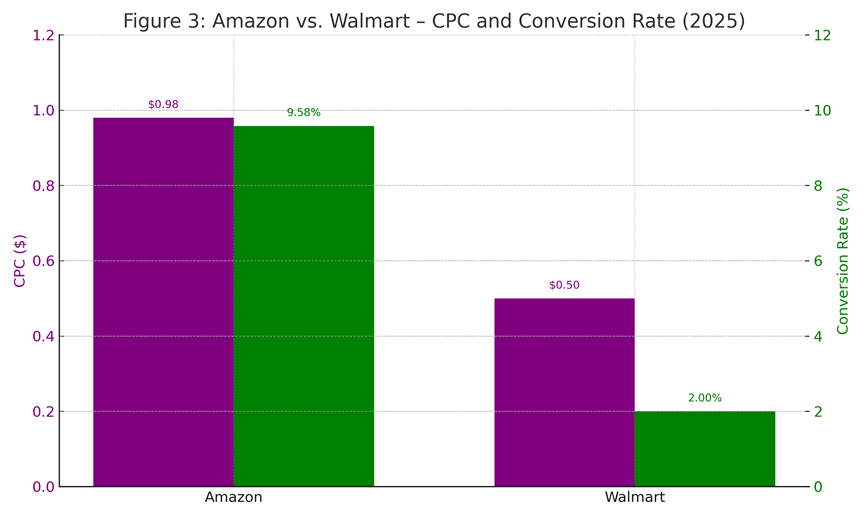

If search reveals what a shopper wants, a retail marketplace reveals where the wallet opens. Amazon pioneered retail‑media by turning every product detail page into a miniature search engine. Sponsored Products averaged about $0.71 per click in 2020. By early 2025 the median price sits just under a dollar. Costs climbed roughly thirty‑eight percent, but the payoff remains striking: internal case studies and third‑party audits peg the average sale conversion rate between nine and ten percent. Those clicks convert three to four times better than a comparable e‑commerce keyword on Google. Why? Trust and friction. Amazon shoppers have a default payment method, stored shipping addresses, Prime promises, and social proof from millions of reviews—all reducing psychological and logistical friction at checkout. Walmart Connect is following the same playbook. Its Sponsored Products inventory reached scale only in 2023, so absolute click costs remain lower, but click‑through sits around 0.21 percent—an order of magnitude under Amazon—and advertiser surveys suggest materially lower sale conversion. Target Roundel, Instacart Ads, and Kroger Precision Marketing are earlier in the cycle: CPMs and CPCs look attractive today, but history says they will rise quickly as more brands pile in. Retail‑media offers an arbitrage window, not a perpetual bargain.

Amazon Sponsored Products (2025):

https://www.creator-hero.com/blog/amazon-advertising-costs-in-2025

https://www.adbadger.com/blog/amazon-advertising-stats/

Walmart Sponsored Products (2025):

https://www.teikametrics.com/blog/amazon-walmart-2024/

3 | Scroll More, Stare Less: The Social Paradox

Globally the average person now spends two hours and twenty‑three minutes per day inside social apps, according to DataReportal’s 2024 survey of 48 countries. On the surface that looks like a bonanza of new attention. Dig a layer deeper and each content item receives only a sliver of focus. Meta’s eye‑tracking study shows the average mobile feed item holds a user’s gaze for 1.7 seconds; desktop hovers at 2.5 seconds. That implies one ordinary session exposes a person to roughly two thousand discrete images, stories, or videos. Advertisers cannot lengthen the slice, so they cram more impressions into the stream. The result is CPM inflation without proportional growth in clicks. Facebook traffic campaigns sit in the seven‑to‑eight‑dollar CPM range with link click‑through around 1.5 percent. TikTok currently sells reach for about $3.20 CPM with link CTR just under one percent. Snapchat, still popular among teens, charges north of $8.80 CPM while link clicks hover below half a percent. The tactical response is creative built for a one‑second audition: bold motion in the first frame, captions for mute‑watching, and strong visual branding before the viewer scrolls away. Advertisers who ignore these realities find themselves paying premium CPMs for vanishingly small engagement.

Social Media Usage (Daily Minutes)

2012–2020 estimates: GWI and Statista via We Are Social + Hootsuite

https://datareportal.com/reports/digital-2021-global-overview-report

2024 value: DataReportal, “Digital 2024: Global Overview Report”

https://datareportal.com/reports/digital-2024-global-overview-report

Gaze Duration per Post (Seconds)

2012–2018 values based on Meta (Facebook) internal eye-tracking study

Reported by Time.com (2016): https://time.com/4477559/internet-attention-span/

2020–2024 values interpolated from consistent industry reference by Meta (used in ad deck performance data, e.g. Meta for Business).

Social platforms increasingly operate on a volatile attention economy. While daily usage continues to rise, the cost of reaching users (CPM) has inflated across the board, even as actual engagement (CTR) remains modest. Facebook leads with a relatively strong 1.57% CTR, but advertisers pay a premium at $7.19 CPM. TikTok offers more cost-efficient reach at $3.21 CPM, though its 0.84% CTR reflects the challenge of turning fast-scroll behavior into clicks. Meanwhile, Snapchat charges the most—$8.85 CPM—but delivers the lowest CTR at just 0.46%, suggesting high brand visibility but limited direct engagement. In short, attention on social is expensive, unpredictable, and must be earned in milliseconds. Ads must win a thumb‑stop before they can win a click — and then, they must communicate clearly without sound. Recent data indicates that 92% of social media videos are watched without sound (including ads), highlighting the necessity for captions and visual storytelling.

Graph sources:

TikTok – CPM = $3.21, CTR = 0.84%

https://instapage.com/blog/tiktok-advertising

Facebook – CPM = $7.19, CTR = 1.57%

https://www.wordstream.com/blog/ws/2023/06/06/facebook-ads-cost

Instagram – CPM = $3.50, CTR = 0.59%

https://inbeat.co/blog/instagram-ads-cost/

Snapchat – CPM = $8.85, CTR = 0.46%

https://madgicx.com/blog/snapchat-ads-cost

4 | Cookies Survive, Attention Remains the Bottleneck

For five years the industry braced for a cookie apocalypse. Safari and Firefox blocked third‑party cookies by default and Chrome announced a deprecation timeline. On 22 April 2025 Google quietly reversed course, stating that Chrome would keep third‑party cookies indefinitely while it explored Privacy Sandbox alternatives. Many marketers sighed with relief, yet every performance graph shows the real constraint is not identity but attention. Display click‑through remains below half a percent, Google Search CPCs rise around twelve percent each year, and social CPMs continue to inflate even as link clicks stagnate. Identity solutions such as data clean rooms, hashed email matching, and cohort targeting may sharpen relevance, but they do not create new seconds in the human day. Scarce micro‑attention, not scarce IDs, is the choke‑point that will define media economics for the next decade.

Display ad CTR remains below half a percent:

https://firstpagesage.com/seo-blog/google-ads-average-clickthrough-rates/

Google Search CPCs rise ~12% per year:

https://searchengineland.com/report-google-search-cpc-up-13-yoy-ad-spend-growth-slowing-439860

Social media CPMs continue to inflate (Meta + TikTok):

https://www.guptamedia.com/social-media-ads-cost

https://www.emarketer.com/content/social-ad-cpms-forecast-2024

5 | How to Win in a Micro‑Attention World

• Bid only when intent screams purchase. Accept higher CPCs in search and retail media because conversion odds justify the premium.

• Design for the first second. Lead with motion, front‑load branding, and use readable captions because a significant portion of your audience watches on mute.

• Exploit under‑priced pockets early. Bing clicks, Instacart placements, and TikTok Shop videos look inexpensive until competitors flood the auction.

• Measure outcomes beyond clicks. When click‑through approaches rounding error, optimize for incremental revenue, add‑to‑cart rate, and lifetime value.

• Own your data exhaust. Email engagement, loyalty transactions, and app events remain durable even if policy tides shift; these signals feed look‑alike models and suppress cost when broad targeting becomes prohibitively expensive.

Closing Beat

Advertising is not dying; it is atomizing. Attention now arrives in millisecond packets, and value concentrates around the handful of moments when a consumer is ready to act. Brands that compress a message into those packets and reserve bids for peak‑intent moments will thrive. Everyone else will keep paying more and more—only to be scrolled past in silence.